Can you live off interest of 2 million dollars?

Summary of the Article: Can you live off interest of 2 million dollars?

How much interest does 2 million dollars earn per year?

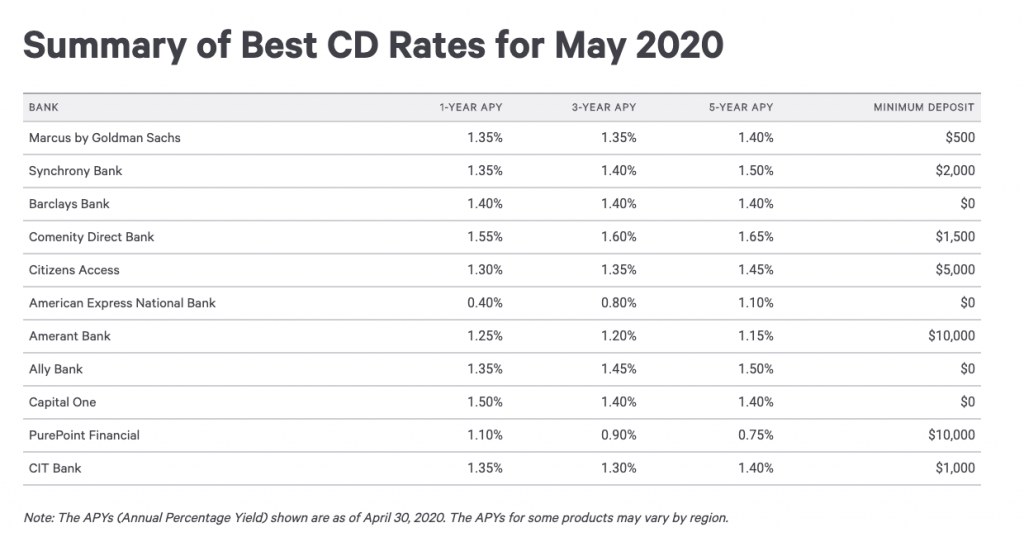

The quick answer is that you could make as high as $100,000 a year of pre-tax interest income on $2,000,000 if you invest it in a 1-year Certificate of Deposit (CD).

How long can you live with $2 million dollars?

The short answer is, most likely it will last you comfortably for the rest of your life. The longer answer is, even with no growth of any kind, this nest egg will last an average household around 35 years.

Can you retire with $2 million dollars?

Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are a lot of challenges you’ll face. As of 2023, it seems the number of obstacles to successful retirement continues to grow.

What percentage of US population has $2 million dollars?

Additionally, statistics show that the top 2% of the United States population has a net worth of about $2.4 million. On the other hand, the top 5% wealthiest Americans have a net worth of just over $1 million. Therefore, about 2% of the population possesses enough wealth to meet the current definition of being rich.

How much income will 2 million generate?

A $2 million retirement account invested entirely in an S&P 500 index fund would return an average of $200,000 per year. That’s enough for most households to live on without even dipping into the principal, but in some years that account would take significant losses.

Can I retire at 45 with $2 million dollars?

Retiring at 45 with $2 million takes diligent saving and detailed planning, but it is possible. However, you’ll have between 20 and 25 years to save, so you must save nearly $3,000 each to hit your goal.

Can a couple retire at 55 with $2 million dollars?

Yes, you can retire at 55 with 2 million dollars. At age 55, an annuity will provide a guaranteed income of $130,000 annually, starting immediately for the rest of the insured’s lifetime. The income will stay the same and never decrease.

How long would $2 million last in retirement?

Assuming you will need $80,000 annually to cover your basic living expenses, your $2 million would last for 25 years without inflation. However, if inflation averaged 3% annually, your $2 million would only last for 20 years.

Is $2 million a multi-millionaire?

Dated ways of describing someone worth n millions are “n-fold millionaire” and “millionaire n times over”. Still commonly used is multimillionaire, which refers to individuals with net assets of 2 million or more of a currency.

What net worth is considered upper class?

You might need $5 million to $10 million to qualify as having a very high net worth while it may take $30 million or more to be considered ultra-high net worth. That’s how financial advisors typically view wealth.

Can you retire at 55 with $2 million?

If you have multiple income streams, a detailed spending plan and keep extra expenses to a minimum, you can retire at 55 on $2 million. However, because each retiree has unique circumstances, it’s essential to consult a financial advisor to determine the best course of action.

How much interest does 2 million dollars earn per year

So, what is the yearly interest on $2 million dollars if you put that money in the bank The quick answer is that you could make as high $100,000 a year of pre-tax interest income on $2,000,000 if you invest it in a 1-year Certificate of Deposit (CD).

How long can you live with $2 million dollars

How long will $2 million last The short answer is, most likely it will last you comfortably for the rest of your life. The longer answer is, even with no growth of any kind this nest egg will last an average household around 35 years.

Can you retire with $2 million dollars

Yes, for some people, $2 million should be more than enough to retire. For others, $2 million may not even scratch the surface. The answer depends on your personal situation and there are lot of challenges you'll face. As of 2023, it seems the number of obstacles to a successful retirement continues to grow.

What percentage of US population has $2 million dollars

Additionally, statistics show that the top 2% of the United States population has a net worth of about $2.4 million. On the other hand, the top 5% wealthiest Americans have a net worth of just over $1 million. Therefore, about 2% of the population possesses enough wealth to meet the current definition of being rich.

How much income will 2 million generate

A $2 million retirement account invested entirely in an S&P 500 index fund would return an average of $200,000 per year. That's enough for most households to live on without even dipping into the principal, but in some years that account would take significant losses.

Can I retire at 45 with $2 million dollars

Retiring at 45 with $2 million takes diligent saving and detailed planning, but it is possible. However, you'll have between 20 and 25 years to save, so you must save nearly $3,000 each to hit your goal.

Can a couple retire at 55 with $2 million dollars

Yes, you can retire at 55 with 2 million dollars. At age 55, an annuity will provide a guaranteed income of $130,000 annually, starting immediately for the rest of the insured's lifetime. The income will stay the same and never decrease.

How long would $2 million last in retirement

Assuming you will need $80,000 annually to cover your basic living expenses, your $2 million would last for 25 years without inflation. However, if inflation averaged 3% annually, your $2 million would only last for 20 years.

Is $2 million a multi millionaire

Dated ways of describing someone worth n millions are "n-fold millionaire" and "millionaire n times over". Still commonly used is multimillionaire, which refers to individuals with net assets of 2 million or more of a currency.

What net worth is considered upper class

You might need $5 million to $10 million to qualify as having a very high net worth while it may take $30 million or more to be considered ultra-high net worth. That's how financial advisors typically view wealth.

Can you retire at 55 with $2 million

If you have multiple income streams, a detailed spending plan and keep extra expenses to a minimum, you can retire at 55 on $2 million. However, because each retiree's circumstances are unique, it's essential to define your income and expenses, then run the numbers to ensure retiring at 55 is realistic.

How many people have 2 million dollars in savings

We estimate there are 8,046,080 US households with $2 million or more in net worth. That is roughly 6.25% of all US Households.

Can a couple retire at 62 with $2 million dollars

Can a couple retire with $2 million It's certainly possible, though it really comes down to creating a retirement savings plan that's tailored to you and your partner.

Can my wife and I retire on 2 million dollars

Yes, $2 million should be enough to retire. Annuities provide an income option to pay a guaranteed monthly amount for two lives. Once the first spouse dies, the annuity will continue to pay the same or a reduced amount for the remaining surviving spouse's lifetime.

What percentage of Americans have a net worth of over $1000000

There are 5.3 million millionaires and 770 billionaires living in the United States. Millionaires make up about 2% of the U.S. adult population. While an ultra-high net worth will be out of reach for most, you can amass $1 million by managing money well and investing regularly.

Can I retire at 54 with $2 million dollars

Can A Couple Retire On 2 Million Dollars Yes, $2 million should be enough to retire. Annuities provide an income option to pay a guaranteed monthly amount for two lives.

Can I retire at 55 with $2 million

If you have multiple income streams, a detailed spending plan and keep extra expenses to a minimum, you can retire at 55 on $2 million. However, because each retiree's circumstances are unique, it's essential to define your income and expenses, then run the numbers to ensure retiring at 55 is realistic.

How much retirement income will 2 million generate

Following the 4 percent rule for retirement spending, $2 million could provide about $80,000 per year. That's more than average. The Bureau of Labor Statistics reports that the average 65-year-old spends roughly $4,345 per month in retirement — or $52,141 per year.

How much money do you need to retire with $100000 a year income

This means that if you make $100,000 shortly before retirement, you can start to plan using the ballpark expectation that you'll need about $75,000 a year to live on in retirement. You'll likely need less income in retirement than during your working years because: Most people spend less in retirement.

Can a 50 year old retire on $2 million dollars

Yes, you can retire at 50 with 2 million dollars. At age 50, an annuity will provide a guaranteed income of $125,000 annually, starting immediately for the rest of the insured's lifetime. The income will stay the same and never decrease. annually initially, with the income amount increasing to keep up with inflation.

What net worth is considered wealthy

It takes $2.2 million to be considered wealthy

The data also demonstrated that the 48% of Americans who feel wealthy today have an average net worth of $560,000, compared to the $2.2 million they say it takes to be considered wealthy.

What does a 2 million dollar retirement look like

For example, if a 55-year-old person purchases a $2 million annuity with a lifetime income rider and wants to retire in 10 years at age 65, that person would receive roughly $20,242 per month for the rest of their life. If you live for 30 years in retirement, you will receive $7.3 million in payments.

Can I retire at 65 with 2.5 million dollars

For most people, it will be little or no problem to retire at age 65 if they have $2.5 million in savings. This amount of capital invested prudently is likely to provide sufficient income for a lifestyle comfortable enough to satisfy a large majority of retirees.

What net worth makes you upper class

You might need $5 million to $10 million to qualify as having a very high net worth while it may take $30 million or more to be considered ultra-high net worth. That's how financial advisors typically view wealth.